If you’ve ever stared at an Explanation of Benefits (EOB) or a remittance advice and felt completely lost, you’re not alone. These documents are filled with cryptic codes that can make your head spin. But there’s one set of codes that, once you understand it, can transform your confusion into clarity: entity codes.

So, what is an entity code in medical billing? In simple terms, an entity code is a number on your EOB that tells you who is responsible for the financial decision on your claim. It points the finger at the party that made the adjustment, denial, or payment.

After over a decade in healthcare revenue cycle management, I can tell you that mastering entity codes is a non-negotiable skill for anyone who wants to efficiently resolve claim issues. This isn’t just academic knowledge; it’s the practical key that unlocks faster payments and stops you from wasting time arguing with the wrong party. Let’s break down exactly how these codes work and how you can use them to your advantage.

Entity Code Definition: The “Who” in the Story

Let’s make this as clear as possible. Think of a claim denial or adjustment as a story. For you to understand the story, you need to know two things:

-

What happened? (The action)

-

Who did it? (The responsible party)

This is precisely how standard medical billing communication works. The Claim Adjustment Reason Code (CARC) tells you the “what.” It answers the question, “Why was this claim adjusted or denied?” Reasons include things like “deductible,” “coinsurance,” or “service not covered.”

The Entity Code tells you the “who.” It identifies the entity that made the decision described by the reason code.

Without the entity code, you have a problem without a clear source. You know what went wrong, but you don’t know who to contact to fix it. This code eliminates that guesswork.

How Entity Codes and Reason Codes Work Together

You will never see an entity code living alone on a remittance advice. It always partners with a Claim Adjustment Reason Code (CARC) to give you the full picture. This powerful duo is the industry’s standard way of communicating claim status.

Here is a real-world example of how they work in tandem:

-

Scenario: A claim line is paid at a lower rate than you billed.

-

The Reason Code (CARC):

45– Charge exceeds fee schedule/maximum allowable. -

The Entity Code:

PR– Payer.

Your Instant Interpretation: The Payer (who) reduced the payment because the billed amount was higher than their contracted rate (what).

This combination immediately tells you that this is not a mistake; it’s a contractual adjustment. You now know that appealing this adjustment is pointless because it’s based on your provider’s signed contract with that insurance company. Your only action is to write off the difference.

Conversely, if the entity code was PAT (Patient), and the reason code was 16 (Claim/service lacks information), you would know that the patient is responsible for providing more information. This guides your front office to contact the patient directly.

Decoding the Most Common Entity Codes You’ll See

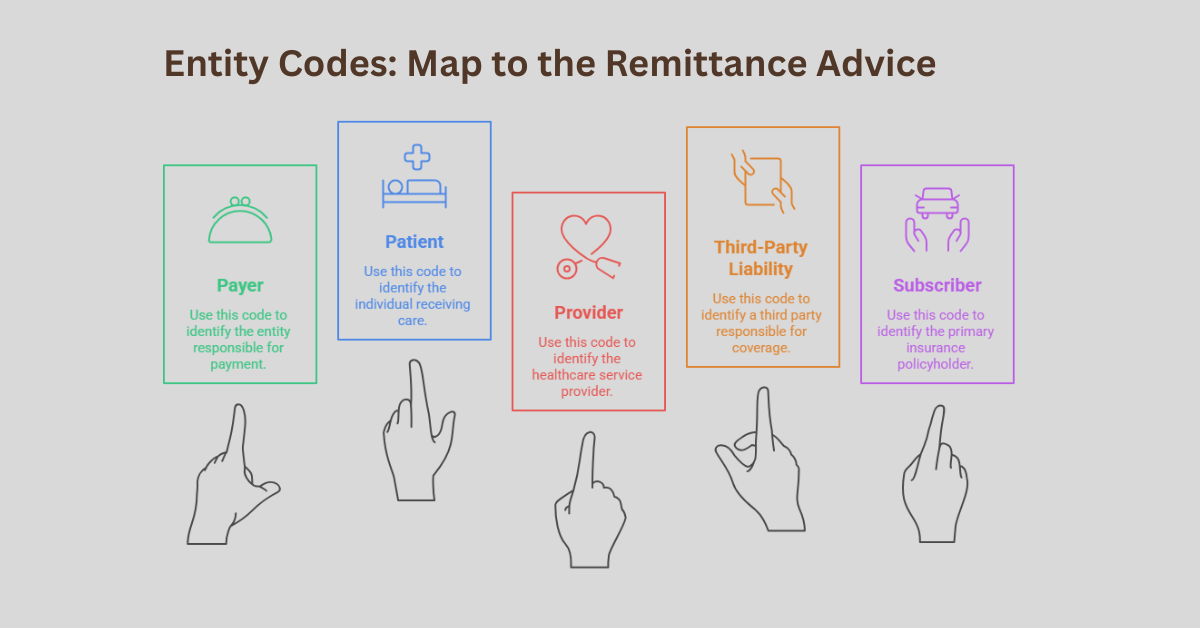

While there are many entity codes, a handful of them appear on the vast majority of remittance advices. Knowing these by heart will make you significantly more efficient.

PR – Payer

This is the most common entity code you will encounter. It means the insurance company itself is the entity that made the decision. You see this with contractual adjustments, coverage determinations, and many denials.

PAT – Patient

This code indicates that the patient is the responsible entity. This often happens when the claim is missing a referral, the service isn’t covered under the patient’s plan, or the patient hasn’t met their deductible. It signals that the balance may be billable to the patient.

PR – Provider

Yes, the code “PR” can mean either Payer or Provider depending on the context, which is a common point of confusion. When “PR” refers to the provider, it means your practice or facility is the responsible entity. This could be due to a billing error you made that you now need to correct.

TPL – Third-Party Liability

This entity code is crucial for accident-related claims. It means that another payer, like auto insurance or workers’ compensation, is primarily responsible for payment. It tells you to redirect the claim to that third party.

AO – Subscriber

This points to the person who holds the insurance policy. You might see this if there is an issue with the subscriber’s eligibility or if they are responsible for providing additional information.

The Practical Power of Entity Codes: How to Use Them

Understanding what is an entity code in medical billing is one thing; using it to improve your workflow is where the real payoff happens.

Streamlining Your Denial Management Process

Entity codes are your first and most important filter in denial management. Instead of treating every denial the same way, you can sort them by entity code.

-

Entity Code = PR (Payer): These denials require you to check the payer’s specific policy and, if you disagree, prepare an appeal with supporting documentation.

-

Entity Code = PAT (Patient): These “denials” instantly route to your front-office staff or patient billing department to contact the patient for information or payment.

-

Entity Code = TPL: These claims are immediately forwarded to your third-party liability billing specialist.

This simple sorting step can cut your research time in half by sending the issue to the right person from the start.

Preventing Costly Missteps and Write-Offs

Perhaps the most valuable function of an entity code is preventing you from making a costly error. A very common mistake is to automatically bill a patient for a balance without checking the entity code.

For example, if a claim is denied for “non-covered services” and the entity code is PR (Payer), you likely cannot bill the patient unless you had them sign an Advance Beneficiary Notice (ABN). If the entity code is PAT (Patient), you probably can. Misinterpreting this leads to lost revenue or compliance issues.

Enhancing Communication and Appeals

When you have to call a payer or write an appeal, leading with the entity code and reason code demonstrates your expertise. You can say, “I’m calling about claim X, which was denied with CARC 204 and entity code PR.” This immediately tells the representative the exact nature of the problem, bypassing layers of basic questions and getting you to a solution much faster.

Beyond the Basics: Pro Tips for Mastering Entity Codes

After years of working with these codes, here are a few insights that separate good billers from great ones.

Always Cross-Reference the Remark Code. Sometimes, the remittance advice will include a third code: a Remark Code. This code provides even more specific, free-text details about the adjustment. The entity code, reason code, and remark code together give you the complete “who, what, and why.”

Beware of Payer-Specific Quirks. While these codes are standardized, some payers use them in slightly different ways. It’s always wise to have that payer’s specific provider manual handy for clarification on complex denials.

Use Them for Reporting. Don’t just use entity codes for individual claims. Use them in your monthly reports. If you see a sudden spike in denials with entity code PAT, it might indicate a problem with your front-end eligibility checking process. This data is invaluable for proactive practice management.

Frequently Asked Questions

What is the difference between an entity code and a CARC?

A Claim Adjustment Reason Code (CARC) explains why a claim was adjusted or denied (the “what”). An entity code identifies who is responsible for that action (the “who”). They are a paired set of information.

Where can I find a complete list of entity codes?

The complete official list of entity codes is maintained by the Centers for Medicare & Medicaid Services (CMS) in their X12 implementation guides. You can also find simplified, user-friendly lists on the websites of major payers and professional medical billing associations.

Can an entity code tell me to bill the patient?

Yes, indirectly. If the entity code is PAT (Patient) and the reason code indicates patient responsibility (like a deductible or non-covered service), that is your authorization to bill the patient, subject to any contractual agreements.

What does it mean if the entity code is missing?

While rare, if an entity code is missing, it creates ambiguity. In this case, you must rely on the reason code and any remark codes to determine the responsible party. You may need to contact the payer for clarification to ensure you take the correct action.

Are entity codes the same for every insurance company?

Yes, the standard entity codes are mandated for use by all HIPAA-covered entities, including all major insurance companies. This standardization is what makes them so powerful and reliable across different payers.